As impact investors, you understand that every choice you make, including your investment decisions, has an impact. You’re employers and employees, investors, philanthropists, voters, parents, children and so much more. Each of these roles and every dollar of capital you deploy presents an opportunity to help create meaningful change.

While Wetherby may only manage our clients’ investment portfolios, we recognize that our clients may also want to direct these other forms of capital toward impact. Whether it’s investing for college, retirement, or to ultimately give to nonprofits, or with everyday banking transactions, we know that many investors want to activate their full balance sheet in alignment with their social and environmental impact goals.

Here we’ll walk you through a few creative options for how your money can do more good.

Location Matters

As you consider the whole of your financial assets, take stock of the various accounts in which your money is working for you in important ways. Tax-advantaged investment accounts such as 401(k)s or 529s help you grow your retirement or college savings, while Donor Advised Funds (DAFs) enable you to donate to nonprofit organizations efficiently.

Where these accounts are held matters. It will determine which impact investment options you have available – or even if you have access to impact options at all. In addition, you may find that you are indirectly supporting institutions whose operations conflict with your impact values. As just one example, major banks have poured more than $3.6 trillion into fossil fuels in the past five years; any assets in accounts held at these banks may indirectly finance fossil fuel investments.1

By taking a holistic and informed approach, you can ensure that all of your assets align with your values and actively support both your impact and financial goals.

Double Down on Donor Impact – Donor Advised Funds (DAFs)

Many impact investors use philanthropy strategically alongside their portfolios to provide catalytic capital to a proof-of-concept idea that may not yet be investable or to support worthy causes that do not generate a financial return.

Philanthropy and for-profit investment do not have to exist in a binary, and the concepts are not mutually exclusive. Donors who use DAFs can double the positive impact of their dollars. Using a DAF, individuals contribute tax-qualified donations into a managed investment account to be later granted to eligible nonprofit organizations of their choice. By investing in impact funds, your money gets to work supporting social and environmental causes right away, even before being donated to the cause of your choice.

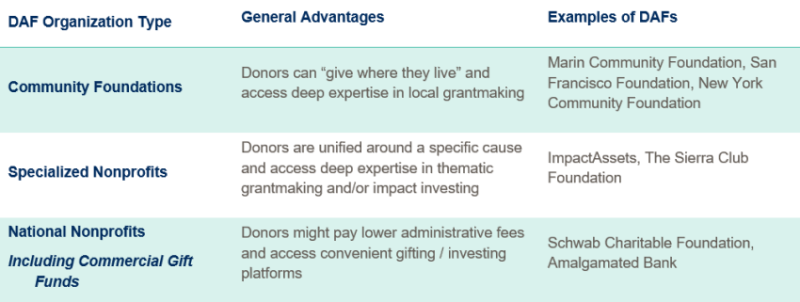

Organizations that offer DAFs typically fall into three main types that reflect slightly different approaches to administering and supporting DAF accounts. A growing number of these organizations now also offer impact funds as part of your investment options.

With the myriad of considerations, your wealth manager can help you to identify an appropriate DAF organization aligned with your goals and the positive impact you hope to support.

A Brighter Future for Education and For All – 529s

With the cost of college on the rise, many individuals are getting an early start putting aside money to cover the various associated expenses such as tuition, books and other qualified expenses. 529s provide a tax-advantaged option to invest these savings until you or your beneficiary are off to college.

529 administrators are now offering increasingly robust impact investment options – with at least 15 plans incorporating options that integrate environmental, social or governance criteria as of June 2020.2 Getting the most out of your 529 requires evaluating the general characteristics of these accounts, along with their impact investment options.

- State and federal tax benefits could be available depending on your geography. Consider which administrator provides the greatest tax advantages for your circumstance.

- Administrators will differ in what constitutes qualified education expenses, which investment funds, including impact funds, are available, and how flexible their portfolio strategies might be.

- Fees can vary based on the administrator, the funds selected in the portfolio and whether they bill for auxiliary services like document delivery. Make sure you know the full cost of each plan as you compare options.

In some instances, a creative approach – such as supplementing a traditional age-based portfolio with a custom impact fund based carve-out may be the best way to achieve your goals and deepen your impact along the way. For example, portfolio options may be static, age-based (which become more conservatively balanced as children approach college age) or allow you to customize part or all of the portfolio.

If you find yourself needing additional guidance, your wealth advisor can help you evaluate options and choose the portfolio best suited for your goals.

Investing in Your Future – 401(K)s

While investors are typically beholden to their employers for where their retirement savings are managed through a 401(k), it is good practice to evaluate your options periodically.

Recognizing that environmental, social and governance (ESG) diligence is a material component of evaluating long-term investments, many 401(k)s now have enhanced impact options available. Many employers offer simple-to-use impact portfolios designed around a target date or desired risk level. If your 401(k) does not include impact portfolios, you may still be able to split your investments between a pre-set portfolio and individual impact funds.

One other significant action you can take is to advocate to your employer for more and better impact options. Particularly if you have a hand in the decision-making process, this can create meaningful change for your investments and those of your colleagues and employees. It can also be one component of offering your employees the kind of thoughtful benefits that can help you stand out amongst competitors for retaining and acquiring talent. In a recent survey, 69% of retirement-plan participants said they would or might increase their overall contribution rate if their plan offered ESG options.3

Banking Options For Bigger Impact

Banks have a considerable amount of capital that they deploy every day in industries around the world, and as a client, you may have little insight into where that money you’ve deposited is going while held by your bank. Just three major banks — JPMorgan, Citigroup Inc. and Bank of America Corp. — were the top funders of worldwide fossil fuel expansion from 2016 to 2020.4 Banks including Deutsche Bank, BNY Mellon, Citigroup and HSBC are also major funders of palm oil, a crop linked to labor abuses and exploitation in Malaysia and Indonesia.5

The good news is that there is an increasing number of socially responsible, sustainable and otherwise impact-minded financial institutions. You can see the sidebar for resources to help you find one. In addition to the typical considerations like available services and fees, choosing a bank is also an opportunity to consider your theory of change and your impact priorities. For example, some banks have a particular focus on climate change and may be the right choice if you’re especially interested in mitigating your carbon footprint or reducing your reliance on fossil fuels. If you are interested in racial equity or income equality, local credit unions with a track record of investing in the community may be a good option.

If you find yourself unable to move away from a major traditional bank, you still have ways to use that capital in a positive way. While banks are still heavily funding fossil fuels and the finance industry still grapples with problems of racial equity, many have made tangible commitments to improve over time. These changes have been largely due to external pressure from advocacy groups, regulatory bodies and consumers like you. If your chosen bank, whether impact friendly or traditional, has made commitments, keep an eye on their progress and whether they follow through with those promises, and hold them accountable if not.

The industry holds exciting promise as more tools, resources and solutions exist for your capital to create positive change. Your Wetherby team is always available to help you navigate your best options and advise on any implementation to bring you closer to your impact and financial goals.

Resources

1Bloomberg. “Banks Always Backed Fossil Fuel Over Green Projects—Until This Year.” May 19, 2021.

2InvestmentNews. “ESG Gaining Ground in 529 Programs.” June 8, 2020.

3Barron’s. “401(k) Investors Will Soon Be Able to Choose ESG Funds.” July 2, 2021.

4Morning Consult. “60 Largest Banks Invested $3.8 Trillion Into Fossil Fuels in the Five Years After Paris Climate Deal, Report Finds.” March 24, 2021.

5Washington Post. “Palm oil labor abuses linked to world’s top brands, banks.” September 24, 2020.