As we move through fall and into winter, end-of-year planning is naturally top of mind with charitable giving high on the list of priorities. People may naturally be in a giving mood, tax considerations are top of mind and charities are often making a final push to meet their yearly goals or to wrap up fundraising for a particular project. While simply donating with a credit card may be the option that first comes to mind, it’s worth considering other ways to give and how to make the most out of your donations for you and the nonprofits you support.

Donating Appreciated Securities Can Have Tax Advantages

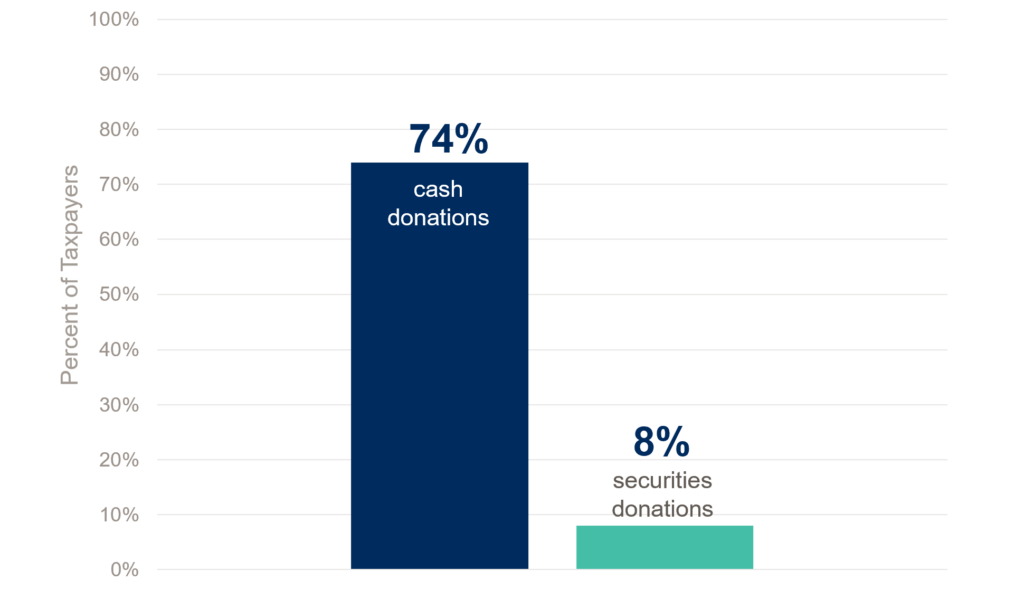

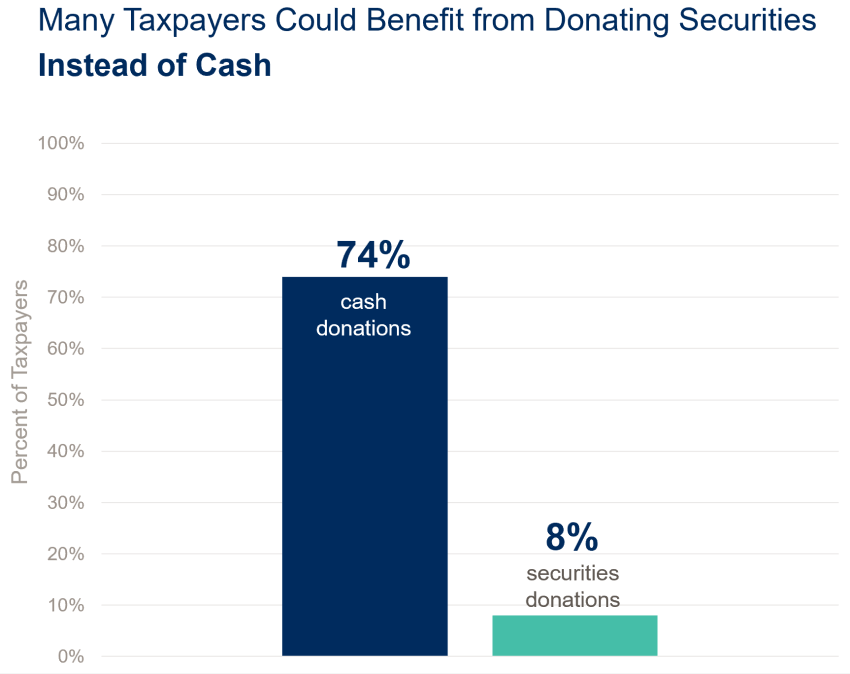

Donating appreciated securities to charities is a great way to avoid paying capital gains taxes on them, but this strategy has surprisingly low adoption among affluent taxpayers. In 2018, IRS data showed that 72% of taxpayers owed capital gains taxes from selling appreciated securities. Despite this, when it came to charitable gifting, 74% were donating cash and only 8% were donating appreciated securities, representing a significant missed opportunity.

Why Give Securities

Under most circumstances, donating appreciated securities that have been held longer than one year from your taxable account will ultimately cost you less than donating the same amount of cash. The unrealized capital gains embedded in the gifted securities are never realized by you since you are donating them to the charity and, as a nonprofit, the charity is not required to pay tax on any gains they receive. This could save you as much as 37% when considering federal and state capital gains tax and net investment income tax. These savings are in addition to the charitable deduction you may be able to take for the donation.

While not as simple as giving cash, donating securities directly to a charity or a charitable giving vehicle like a Donor Advised Fund (DAF) is relatively straightforward, especially if the charity or DAF has an account at the same institution as your brokerage account (e.g. Charles Schwab). When transferring stocks or mutual funds to a charitable account or a DAF at a different institution, the transfer could take as little as a day or as much as a few weeks depending on the type of securities and the capabilities of the other institution. Your Wetherby team can help you understand the likely timeline for your donation and plan accordingly.

Maxing Out Your Deductions

The charitable deduction available for any one tax year is limited to a percentage of your Adjusted Gross Income (AGI). This limit is determined by the type of property donated and the type of charity receiving the donation. Typically, if you gift cash, you can deduct up to 60% of your AGI in the year the gift is made. Whereas if you gift appreciated securities, the maximum deduction is typically 30% of your AGI. If you gift more than the allowable deduction in a particular year, whether in cash or appreciated securities, you can carry forward the unused deduction for five additional years.

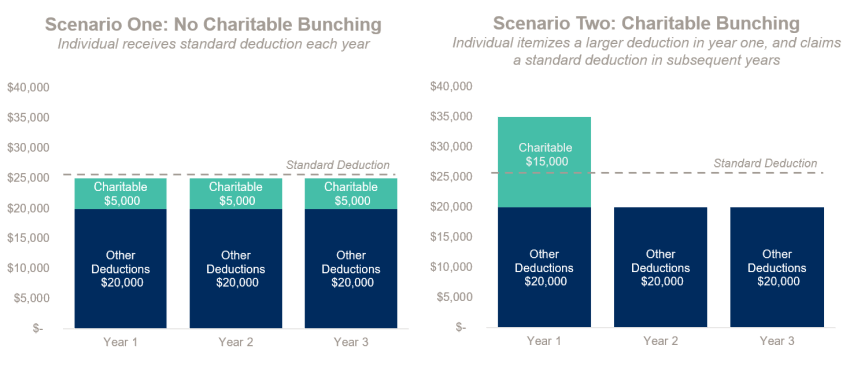

The Benefits of Bunching

If your annual charitable deductions could exceed the standard taxable deduction by bunching them into one year, doing so could save additional money on your taxes. Known as charitable bunching, individuals who routinely donate to charities make multiple years of donations in one year and then skip the following years. This allows them to take advantage of a larger charitable tax write off initially and subsequently benefit from the standard deduction. These individuals ultimately give the same total amount to charity but now receive additional tax benefit from the donation.

Qualified Charitable Distributions From an IRA

For those over age 70 ½, another option for giving is to gift directly from your IRA to a charity. Known as a Qualified Charitable Distribution, eligible individuals can satisfy some or all of their required minimum distributions without adding to their taxable income. This is a potentially useful strategy in years where giving cash or appreciated securities from a non-retirement account would have limited tax advantages.

When to Use Your DAF

A Donor Advised Fund (DAF) has many advantages for gifting to nonprofits. If you don’t already have a specific charity in mind that you’d like to donate to, contributing to your DAF can still give you the tax benefits for this year and give you time to decide to which charitable cause to direct your gift. Smaller nonprofits may also benefit from receiving a check from your DAF as opposed to having to deal with appreciated stocks or mutual funds.

If making a grant from your DAF, remember that it can take some time to process. While it doesn’t impact your tax situation, since you would receive a charitable deduction upon funding the DAF and not when directing funds from the DAF to the specific charities, if you’re concerned about the nonprofit having the funds before the end of the year, make sure you start the process with enough time for the transaction to complete.

Help Your Charity Get the Most Out of Your Donations

If you’re considering how to help your nonprofit make the most of your gift, there are a few things to keep in mind.

Give in enough time for the gift to count for the nonprofit’s end-of-year accounting. Nonprofits typically have annual fundraising goals, and a large percentage of these donations come towards the year’s end. Making sure that your donation is sent in enough time for the nonprofit to have processed it and be able to include it in their end-of-year accounting can make it easier for them to understand if they’ve met their goals.

Think about how you designate your donation. The rules for how nonprofits spend money are often very specific. If a donation is designated, e.g. earmarked for a particular purpose, those funds can only be used for that purpose. However, donating unrestricted funds gives the nonprofit more flexibility about where they direct those funds and can empower them to do what they consider the most good.

Check with the nonprofit before giving a large gift. If you’re planning on making a significant donation, find out if the organization has any particular preferences about how it is processed and what information they may want from you. Nonprofits are thrilled at your generosity and often want to be able to recognize you and want to make sure that the donation is earmarked appropriately.

Conclusion

Charitable giving often has significant material benefits for you and the nonprofits you support. In many cases, think of any of the methods discussed over the span of several years, rather than in terms of single year advantages. In all cases, discussing all of your available accounts and your charitable goals with your tax professional and your investment advisors can help you decide on a long-term strategy that is as efficient as possible. Thoughtfully considering what to give and how can help you ensure that you and the causes that matter to you get the biggest benefit possible. We encourage you to reach out to your Wetherby team and your tax professional to ensure you maximize benefits to both you and the charitable causes you support.