Tackling the ever-growing issue of climate change may appear to be daunting, but there are steps individuals can take to help fund emission reduction projects and reduce their climate impacts. Carbon offsets are one of these tools. Reducing your carbon footprint is an important strategy to address climate change, but eventually, there are limits to how much we can reduce in a still fossil fuel-dependent society. Hard-to-abate emissions, including those from the transport and industry sectors, can be particularly difficult to reduce and will require breakthroughs in technology, investment, and time to do so. Until these changes are made, carbon offsetting can work as an additional tool to help you mitigate your carbon footprint. Carbon offsetting involves funding projects that prevent future carbon from being released or remove carbon currently in the air. It allows you to have additional impact by reducing your total carbon footprint through local and global projects.

It is important to mention that there are two types of carbon offset markets: compliance and voluntary. Compliance markets provide offsets for industrial emissions sources, like oil companies, who are legally required to reduce or offset their greenhouse gas emissions. Compliance markets are regulated by governments and implement a controlled certification process to qualify carbon credits. Voluntary carbon offsets include those you buy for yourself and those purchased by companies that aren’t required by regulations to use carbon offsets but choose to do so. Voluntary markets are self-regulated.

Carbon offsetting has come a long way from the tree-planting projects that often come to mind. Indeed, tree planting may not be the best carbon offsetting option. Many projects have moved on to better strategies that are faster, more permanent, and cover a wide range of methods, geographic locations, and impact areas. There are still valid criticisms about carbon offsets and their value in combatting climate change. Such criticisms often focus on how offsets are used and the quality of offsetting projects. Carbon offsets can be seen as an excuse to continue environmentally harmful behavior instead of changing the behaviors themselves. This type of criticism is often aimed at companies who may use offsetting to avoid the necessary innovation or change in operations required to meaningfully reduce their carbon emissions.

As these companies come under further scrutiny and new regulations are introduced to address the issue, it is important to focus on using carbon offsets as a way to reduce hard-to-abate emissions until we can develop the technology to avoid them altogether. Individuals and small businesses often face structural limitations to limiting their emissions, whether due to their available resources or due to the availability and practicality of newer, lower emissions technology. In these instances, high quality carbon offsets can function as an important stop gap while technology develops and a plan to further lower emissions comes to fruition.

Criticisms focused on the quality of carbon offset projects highlight concerns on how to verify the impact of a project and the lack of standardization for implementing projects. These concerns are valid and are being addressed as the industry finds ways to improve standards and reporting for carbon offset projects. For example, the Integrity Council for the Voluntary Carbon Market (ICVCM) just released their ten Core Carbon Principals, which provide criteria for projects focusing on governance, registry, verification, sustainability and other factors. Efforts such as these help provide some clarity and guidance on ensuring that projects are delivering meaningful impact and are continuously improving so they can effectively reduce your carbon footprint for the long term.

Depending on your circumstances and priorities, there are various ways to employ carbon offsets. While carbon offsetting alone is not the solution to the issue at hand, it can be a helpful tool when used as one part of a bigger toolbox. Below we’ve compiled a brief guide on how to approach carbon offsets and make them work for .

How Do I Calculate My Carbon Footprint?

The first step when considering carbon offsets is understanding your personal carbon emissions so you can know how much you want to offset. A variety of calculators exist that can help you calculate your carbon footprint that range in complexity from broad to very detailed and specific. Some calculators, like this one from Sustainable Travel, calculate just travel-related emissions. Others, like this one from the Nature Conservancy, calculate a more comprehensive footprint, asking about travel, food, home, and shopping habits. Some calculators, like this one from Native, can calculate emissions for a specific event, like a birthday party or business meeting. This calculator from the EPA calculates your emissions from home energy, transportation, and waste, and can also calculate the reduced emissions and financial savings of changing your habits in those areas.

Once you know your carbon footprint, you can decide what lifestyle changes you may want to make and how much you ultimately want to offset.

Where Can I Get Carbon Offsets?

The next step is to decide how and where to purchase your offsets. There are different ways to buy carbon offsets and a range of organizations with which to work. Companies can deliver options differently: a monthly or yearly plan, purchases per ton of carbon, or packages for a specific amount you want to pay.

The key to choosing between these options is understanding which will allow you to achieve your environmental and broader impact goals most effectively. With the growing number of companies offering carbon offsetting products, it’s important to do your due diligence to find the right one for you.

5 Things to Look For

When researching a company and its projects, there are five characteristics to keep in mind.

- Additionality. This is the idea that the company and its projects create value that would not otherwise exist. In the case of carbon offsetting, is the company helping reduce carbon emissions more than would have happened if the project hadn’t been established? For example, is the company selling carbon offsets for already-protected forests that were not at risk of deforestation? It is also important to consider whether the company is simply moving the emissions elsewhere and therefore not fulfilling its goal to remove or avoid net carbon emissions.

- Permanence. The carbon offsets a project generates should be permanent and there should be a plan to compensate for any risk of a reversal. For example, if a project is focused on reforestation, it is crucial that the company considers possible risks such as fire or disease that could reverse the carbon offsets they promised. Companies must have a plan in place to ensure that their impact is genuine and long-lasting.

- Verification. It is critical for a company to have a reputable third-party verifier that can certify the projects a company undertakes. These may include standards such as the Voluntary Carbon Standard and third-party verifiers, like the American Carbon Registry, Verra, and Climate Action Reserve. These organizations certify that the projects are as promised and actually achieve their stated goals.

- Double Counting, also referred to as “double dipping.” It is important that a company ensures that their projects don’t overlap with any other projects within their own company or as part of other initiatives to ensure that their calculation of how much carbon is being offset is accurate. It is also critical that each carbon offset is sold once and then removed from the market. If not, the effectiveness of the project may be overestimated.

- Leakage. This involves any unintended consequences that result from the projects. A company needs to consider the societal, economic, and environmental effects that their projects may have beyond the boundaries of the project itself. This especially includes the effect on the people in the surrounding community. If there are any potentially harmful effects, does the company attempt to rectify these issues?

In combination, these characteristics can help you find companies and projects that are effective, reputable, and help support your impact goals.

How Do I Understand What My Carbon Offsets Are Really Doing?

Aside from understanding the climate impacts of the projects your carbon offsets are funding, it’s worthwhile to consider the non-environmental outcomes. Often, projects have an impact far beyond carbon offsetting. These areas can include farming, alternative energy sources, methane reduction, sustainable jobs, and improving community health, among others.

For example, a project by Climate Impact Partners in north-eastern Brazil works with the Kitambar ceramics factory to switch its fuel source from unmanaged forest wood to renewable biomass. The project helps reduce deforestation, protects biodiversity, provides educational training courses to staff, supports local construction, encourages clean and affordable energy, and offers better workplace safety for employees.

Projects with these kinds of positive impacts beyond carbon emission reduction or carbon sequestration can help you further your impact goals beyond climate change.

Moving Forward

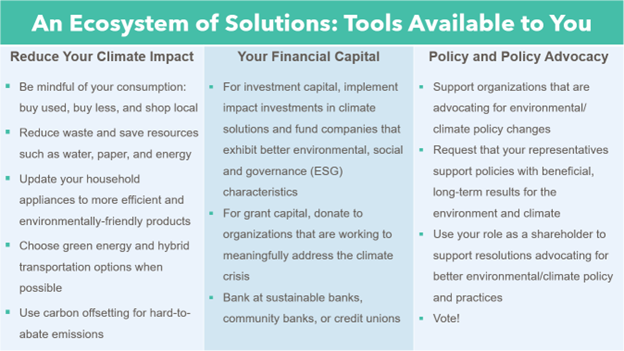

Carbon offsetting is just one tool you have available to make an impact, both within climate change and other impact areas. There is no single solution to solve the climate crisis, but carbon offsetting allows you as an individual to take action and contribute to the larger response to climate change and other issues facing our world. Individual actions like carbon offsets can help you further use your financial capital holistically to achieve your impact goals.

This article was researched and written by our 2022 summer intern, Anna Valadao-Defaria. We are grateful to her for her time and effort and to the Posse Foundation for connecting us.