Impact

Invest for impact

profitably

profitably

LNW’s team can help you earn a return on your investments and generate positive impact that matters to you

It Starts with You

At LNW, impact investing is a portfolio strategy that is driven by what you care about and the type of impact you want to have.

Guide to Impact Investing

If you are considering including impact investments in your portfolio for the first time or are looking to broaden your existing impact focus, our guide looks to help you deepen your understanding and grow your confidence in the power and value of impact investing.

Investing Can Do More Than Build Personal Wealth

It can be a powerful tool to improve the world we live in. At LNW, we believe you can achieve both. We call the intersection between your financial goals and those you have for our communities and the environment impact investing.

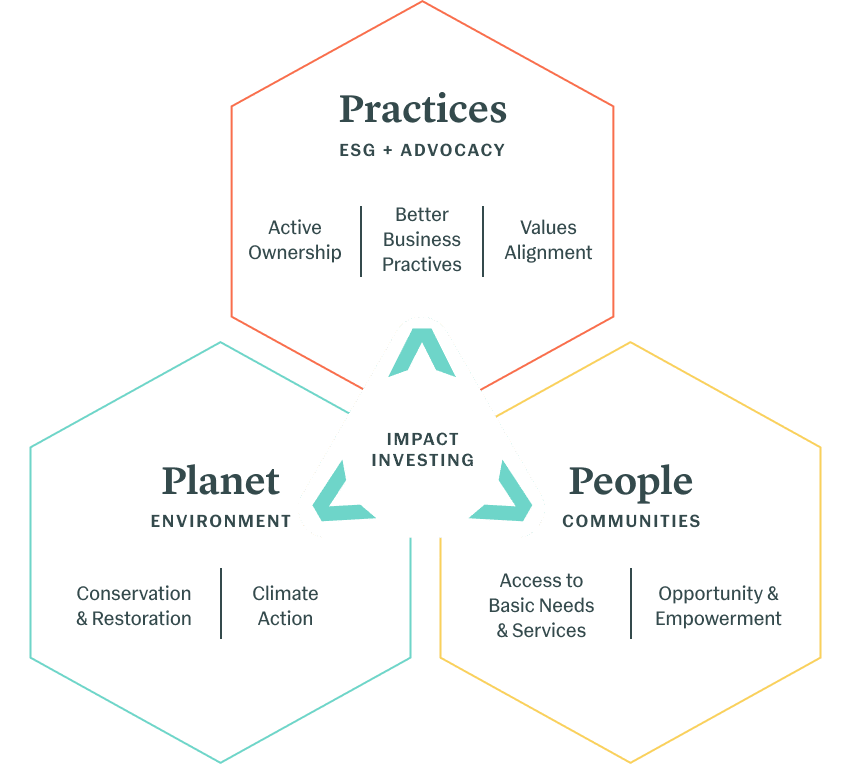

There are many different ways to invest for impact, including responsible investing, ESG (environmental, social and governance) integration, thematic investing and catalytic investing.

Like the rest of our work for you, impact investing is a highly customized process. Regardless of which strategies will work best for you or if you employ one or many, they all serve a bigger purpose: activating your portfolio to achieve your financial goals while prioritizing the environmental and social issues you care about most.

LNW Impact Investing Strategy

Your Goals / Our Expertise

We help you crystallize and prioritize the social and environmental challenges you want to address in context of your overall wealth plan, which we design to achieve your financial, non-financial and impact goals.

Customized Strategy

We develop a customized impact investment strategy to meet your impact objectives. Many impact themes are interrelated and can include climate change, opportunity & empowerment, financial inclusion and improved access to quality education, affordable housing and healthcare.

Total Portfolio Approach

Your impact objectives are not separated from your financial goals. We create portfolios that work on both levels – impact and financial return – using a variety of asset classes in both the public and private markets (private equity and venture capital, private debt and real assets) to optimize risk, return and impact for your unique needs and aspirations.

Journey We Take Together

We guide you through the shifting landscape of impact investment opportunities, while sharing our own learning and client best practices. Your strategy is iterative and flexible, evolving over time to reflect new opportunities and developments at the forefront of impact investing.

Built-in Monitoring and Reporting

We provide in-depth, customized impact reporting on your impact investment strategy. We monitor your investments and check with you regularly on changes to your impact goals.

LNW Impact Investing Principles

We seek to identify those opportunities where the impact strategy drives investment value.

-

No Compromise

We believe that impact investing can serve to reduce risk and/or enhance returns. It does not require us to accept a sub-par risk/return profile. Impact considerations such as climate change and social justice are increasingly relevant to asset pricing, creating many new investment opportunities and risks.

-

Holistic Alignment

We look for impact alignment in business practices and operations and hold ourselves and the asset managers we work with to best-in-class environmental, social and governance standards.

-

Impact Management

We think impact measurement and management can be used to improve both impact and financial returns over time. We seek to deepen our collective impact by using our investor voice to support progress.

-

Evolution

We do not believe in making the perfect the enemy of the good; we believe in getting started and pushing to broaden and deepen impact as the market evolves.

How We Align Our Impact Objectives

Our impact objectives are mapped to the United Nations’ 17 Sustainable Development Goals (SDGs), a set of collective targets to build an inclusive, sustainable and resilient future for people and planet. The SDGs are fast becoming the global impact investment framework.

Industry Affiliations

LNW is proud to partner with leading networks and communities in the impact investing field to catalyze the use of investment capital in generating meaningful social and environmental impact.

As You Sow harnesses shareholder power to create lasting change that benefits people, planet and profit. Their mission is to promote environmental and social corporate responsibility through shareholder advocacy, coalition building and innovative legal strategies.

The California Green Business Network leads the state and nation in working with small- to medium-sized businesses to create a vibrant green economy. Led by a coalition of cities and counties, the network helps to make our communities healthier and more livable while also conserving resources and saving money.

The Due Diligence 2.0 Commitment is an initiative dedicated to addressing racial bias in the asset management industry by reimagining the due diligence process used to select managers to level the playing field for BIPOC managers.

Invest for Better is a nonprofit campaign on a mission to help women demystify impact investing, take control of their capital and mobilize their money for good. A project of The Philanthropic Initiative (TPI), Invest for Better offers open-source resources to the entire ecosystem of investors, advisors, philanthropists and infrastructure organizations.

The Investor Alliance for Human Rights is a collective action platform convening, informing and activating investors to act on human rights and business risks through targeted action, education and multi-stakeholder engagement.

The FSB Task Force on Climate-Related Financial Disclosures (TCFD) develops voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers and other stakeholders to encourage companies to align their disclosures with investors’ needs.

The Forum for Sustainable and Responsible Investment (US SIF) is a network of investment management and advisory firms, research firms, non-profit associations, pension funds, foundations and other asset owners working to advance sustainable, responsible and impact investing across all asset classes.

Proxy Impact is a proxy voting and shareholder engagement service for foundations, NGOs and other mission-based or socially responsible investors. Proxy Impact offers a full range of shareholder engagement services on social and environmental issues including filing resolutions and corporate dialogues.

Sign up to receive

our impact reports

Annual Impact Report

Our Annual Impact Report highlights the impact efforts and achievements of our clients and our team, as well as our latest impact initiatives.

Shareholder Resolution Impact Report

This annual report reviews the environmental, social and governance shareholder resolutions filed and co-filed by our clients during the proceeding corporate annual meeting season.

"*" indicates required fields